JWP recently worked with Sirkin Research to conduct a survey of over 115 participants to uncover key trends, business objectives, and sentiments around the video broadcasting landscape.

Take a moment to learn about the valuable insights that surfaced which will help to shape business plans for 2023 and beyond.

Be sure to also check out the How Broadcasters Will Navigate 2023 webinar and watch as Dan Rayburn discusses the impact of these results with JWP co-founders Jeroen Wijering and Dave Otten.

Key takeaways:

- Video consumption and subscription services experienced phenomenal growth during the global COVID pandemic.

- Subscription fatigue set in once COVID restrictions eased, resulting in accelerated cancellation rates, which forced services to pivot to advertising based models.

- There is general consensus that economic headwinds will intensify, meaning consumers will increasingly seek out free streaming options.

- Improving operational efficiency, growing and improving the existing audience base, improving viewer engagement, and growing revenue through advertising are the top initiatives for broadcasters in 2023.

How did the broadcasting industry get here?

The COVID-19 pandemic initiated a massive surge in video consumption and subscription services—from 2020 to 2021 there was a 24.5% rise in global video-on-demand subscriptions resulting in $87.3B.

Once COVID restrictions eased and consumers reacclimated to life outside of their homes, many had to reckon with an oversaturation of monthly video subscriptions. As a result, consumers pivoted to free ad supported services integrated with their connected TVs (CTV) such as Tubi, Philo, Pluto, Samsung TV+, and others. Even industry behemoths like Netflix and Disney rolled out significantly lowered priced subscription tiers largely offset by ad revenue. Apple+ is planning a similar rollout for 2023.

As the COVID pandemic wanes, consumers now face numerous challenges including multiple video streaming options, higher inflation, and economic headwinds.

What is the current state of video broadcasting?

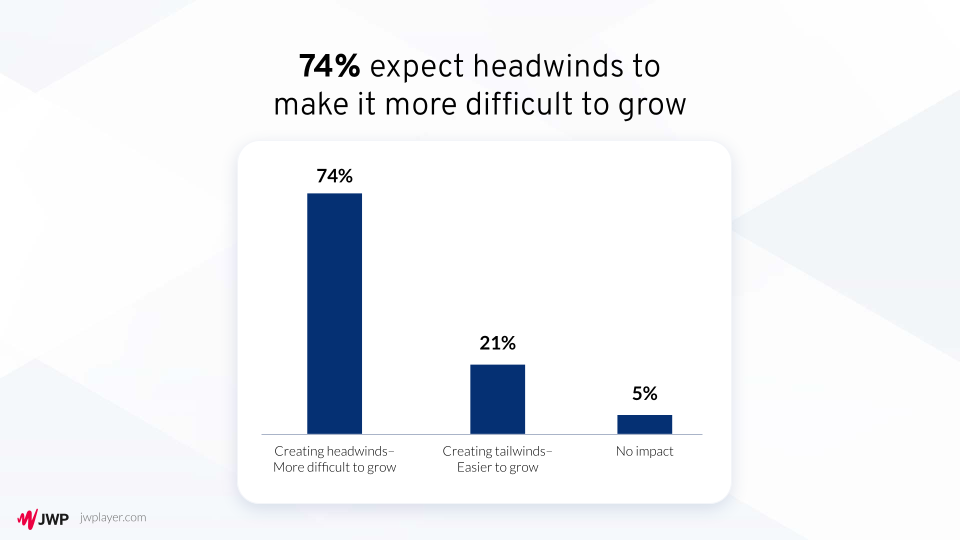

74% of survey respondents expect headwinds to slow business growth in 2023, with most expecting a prolonged recession.

Current economic models predict that there is 100% probability of a recession within the next 12 months. And with 74% of those surveyed saying they expect market headwinds to impact their growth, adjusting current business plans remains top of mind.

These impending headwinds will demand an in-depth look into how the video business is structured today in order to maximize operational efficiency tomorrow.

What steps are broadcasters taking to prepare?

1. Removing operational friction

83% of respondents said that improving operational efficiency was a top objective for 2023.

Managing, delivering, and scaling on-demand and live streaming video to perfection is a highly complex, resource intensive process.

Managing, delivering, and scaling on-demand and live streaming video to perfection is a highly complex, resource intensive process.

That is exactly why 83% of those surveyed believe that improving their broadcasting operations is one of their most important business objectives heading into 2023.

The path to reducing operational friction and curtailing growing costs will require broadcasters to streamline intricate processes, simplify workflows, and eliminate antiquated technology.

2. Expanding and engaging target audiences

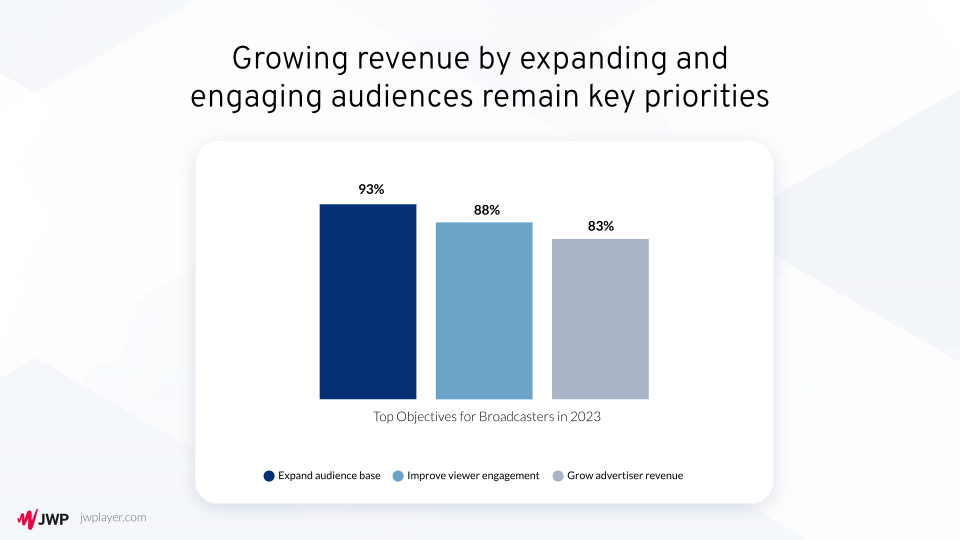

Beyond improving operational efficiency, broadcasters are focused on three main top objectives for 2023:

- Expand audience base (93%)

- Improve viewer engagement (88%)

- Grow advertiser revenue (86%)

Broadcasters are also learning that the staying power of consumers utilizing subscription services is unpredictable, especially during hard economic times. They ranked it as the lowest priority among their initiatives. In fact, 65% of consumers have canceled at least one subscription-based service in the past 12 months.

Where is the video broadcasting industry going?

60% of survey respondents are considering switching solutions for better scalability and efficiency, proof of the impending uncertainty a majority of broadcasters are anticipating.

The good news is that despite economic turbulence consistently dominating the headlines, three underlying certainties persist:

- The demand for broadcast video and live streaming will only keep growing as the market becomes more competitive

- Consumers have a plethora of live streaming options, so broadcasters need to ensure they’re consistently engaging with their audience on any screen and any device

- Organizations that leverage an end-to-end platform with efficient workflows, integrated monetization capabilities, and broadcast-grade scalability and reliability stand the best chance of weathering any storm.

About the research

JWP commissioned Sirkin Research, the leading custom research service for B2B marketers, to conduct a custom online survey. The survey was completed by 116 participants across B2B organizations the majority from North America and EMEA. Of all the respondents 70% worked at organizations with $1M to $50M in revenue and 30% were from organizations with $50M to over $5B. The survey concluded in October, 2022 The participants were from the following business functions/departments:

- Engineering

- Product

- Content

- Operations

- Digital

- Revenue

JWP is the leading online video platform (OVP) providing companies with a scalable and easy way to build, run, and grow their video-driven business. The JWP platform includes all the tools, workflows, and analytics needed to flawlessly deliver engaging video experiences and drive measurable business results. Today, JWP powers video for hundreds of thousands of companies, including half of the Comscore top 50 sites and many of the best-known media, broadcasting, online learning, and online fitness companies across the globe. Each month 1 billion viewers consume video on the JWP video platform across 2.7 billion devices. The company is headquartered in New York, with offices in London and Eindhoven. Visit https://www.jwplayer.com/ to learn more.